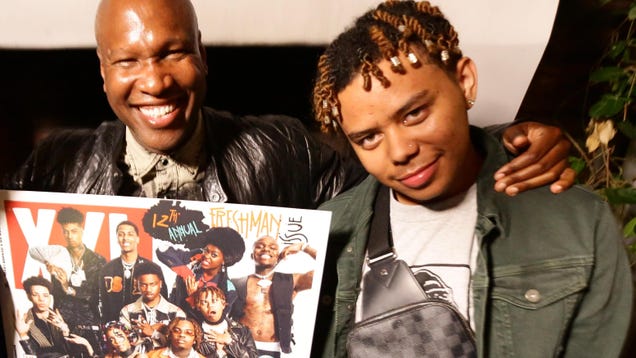

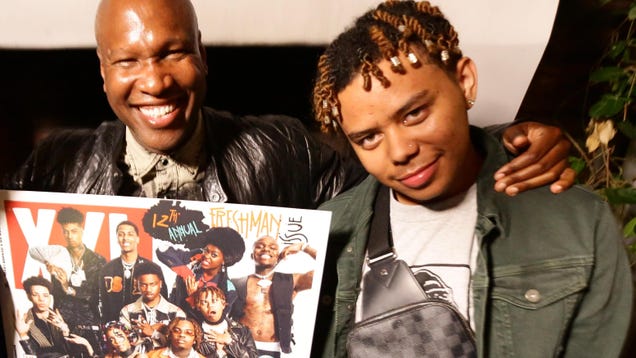

James McMillan has come a long way since his drug-dealing days at an HBCU.

from The Root https://ift.tt/2Rsv0e1

James McMillan has come a long way since his drug-dealing days at an HBCU.

Another day, another installment in the ongoing saga that is “y’alls President is a lying ass liar.” Our subject for tonight’s episode is entitlements.

Medicare is a federal insurance program with four parts—Part A, Part B, Part C and Part D. Part A and B are known as Original Medicare. AARP Medicare Supplement plans help pay for some of the costs not covered by Original Medicare. Part C, also known as Medicare Advantage, offers insurance coverage through private companies such as AARP. In order to sign up for AARP Medicare plans you must be enrolled in Original Medicare.

Part D provides prescription drug coverage. Prescription drug coverage is available to AARP members through the prescription drug plans (PDPs).AARP offers Medicare plans insured by UnitedHealthcare Company. UHC is a private insurance company that contracts through Medicare to provide coverage to beneficiaries. Below are the Medicare health insurance plan offerings through AARP.

AARP Medicare Advantage plans, insured through UnitedHealthcare, include Medicare Part A (hospital stays), Medicare Part B (doctor visits) and, in most cases, Medicare Part D (prescription drug coverage).

Every plan has its own unique benefits. Additional plan benefits may include:

|

|

Most AARP Medicare Advantage plans (Part C) include Part D coverage. Medicare Part D, also known as a Medicare prescription plan, helps cover the cost of your medication.

All plans include brand and generic drugs, but vary in terms of which specific drugs it covers. The list of drugs a plan covers is known as its formulary. Within the formulary, there are tiers of drugs. The higher the tier, the more expensive the drug.

| Tier Type | Tier 1 | Tier 2 | Tier 3 | Tier 4 | Tier 5 |

| Drug Type | Preferred Generic Drugs | Non-PreferredGeneric Drugs | Preferred Generic and Brand Drugs | Non-Preferred Generic and Brand Drugs | Specialty Drugs |

| Copay Cost | $ | $$ | $$$ | $$$$ | $$$$$ |

Medicare Supplement insurance plans, also known as Medigap, help pay for some of the healthcare costs not covered by Medicare Part A and Part B. These costs include coinsurance, copays, and deductibles.

In addition to covering healthcare costs, some of AARP’s supplement plans include the following benefits:

To be eligible to apply for a Medicare Supplement plan, you must be an AARP member or spouse of a member, enrolled in both Part A and Part B of Medicare, and not covered under any other Medicare Supplement plans.

If you are not yet age 65, you are only eligible to apply if you do not have end-stage renal disease and then you may only apply for A, B, C, F or K, unless you are in your birthday Open Enrollment Period and replacing a Medicare Supplement plan.

You must apply within six months after enrolling in Medicare Part B or receiving notification of your retroactive eligibility for Medicare Part B, unless you are entitled to Guaranteed Issue.

All AARP Medicare Advantage plans include the following payments:

The amount of each payment varies based upon the plan you choose and your state or region. The payments associated with PDP plans depend upon the tier of the drugs as described above in the Medicare prescription drugs section.

In order to enroll into AARP Medicare, you must:

To apply to be an AARP member, visit AARP.org/membership. On their site you will also find the monthly payment information and a full list of the benefits provided to members. In addition to healthcare insurance, AARP also offers car, vehicle, and property insurance, as well as a plethora of other benefits offered to members.

The second step is to be enrolled into Original Medicare. You will be automatically enrolled in Medicare Part A once you qualify for federal retirement benefits. If you are not automatically enrolled, you will need to enroll during your Initial Enrollment Period. The initial enrollment period begins three months before your 65th birthday and ends three months after your birthday. If you miss this period, you can enroll during the general enrollment which runs from January 1 to March 1.

You can enroll into Medicare Part B during the same time periods. This can be the Initial Enrollment Period or the General Enrollment Period if you happen to miss the initial. In the event of a life change such as your employer or spouse health insurance ends, you will have access to a special enrollment period.

When enrolling in medicare, you can consult an insurance agent or utilize free resources. In order to enroll, you can choose one of the three following options:

Once you are enrolled into Original Medicare, review the plans offered by AARP to determine which one(s) are the best fit for your situation. These plans have a lot of information, so feel free to request a free quote for more information. Call toll-free at 888-OUR-AARP (888-687-2277) or email member@aarp.org.

The “Unite the Right” rally was one of the darkest moments in our countries recent history. The white nationalist rally took the life of 32-year-old Heather Heyer and left countless others injured and scarred. In some good news, one of the key figures behind that rally has been arrested.

Medicare is a federal insurance program with four parts—Part A, Part B, Part C and Part D. Part A and B are known as Original Medicare. AARP Medicare Supplement plans help pay for some of the costs not covered by Original Medicare. Part C, also known as Medicare Advantage, offers insurance coverage through private companies such as AARP. In order to sign up for AARP Medicare plans you must be enrolled in Original Medicare.

Part D provides prescription drug coverage. Prescription drug coverage is available to AARP members through the prescription drug plans (PDPs).AARP offers Medicare plans insured by UnitedHealthcare Company. UHC is a private insurance company that contracts through Medicare to provide coverage to beneficiaries. Below are the Medicare health insurance plan offerings through AARP.

AARP Medicare Advantage plans, insured through UnitedHealthcare, include Medicare Part A (hospital stays), Medicare Part B (doctor visits) and, in most cases, Medicare Part D (prescription drug coverage).

Every plan has its own unique benefits. Additional plan benefits may include:

|

|

Most AARP Medicare Advantage plans (Part C) include Part D coverage. Medicare Part D, also known as a Medicare prescription plan, helps cover the cost of your medication.

All plans include brand and generic drugs, but vary in terms of which specific drugs it covers. The list of drugs a plan covers is known as its formulary. Within the formulary, there are tiers of drugs. The higher the tier, the more expensive the drug.

| Tier Type | Tier 1 | Tier 2 | Tier 3 | Tier 4 | Tier 5 |

| Drug Type | Preferred Generic Drugs | Non-PreferredGeneric Drugs | Preferred Generic and Brand Drugs | Non-Preferred Generic and Brand Drugs | Specialty Drugs |

| Copay Cost | $ | $$ | $$$ | $$$$ | $$$$$ |

Medicare Supplement insurance plans, also known as Medigap, help pay for some of the healthcare costs not covered by Medicare Part A and Part B. These costs include coinsurance, copays, and deductibles.

In addition to covering healthcare costs, some of AARP’s supplement plans include the following benefits:

To be eligible to apply for a Medicare Supplement plan, you must be an AARP member or spouse of a member, enrolled in both Part A and Part B of Medicare, and not covered under any other Medicare Supplement plans.

If you are not yet age 65, you are only eligible to apply if you do not have end-stage renal disease and then you may only apply for A, B, C, F or K, unless you are in your birthday Open Enrollment Period and replacing a Medicare Supplement plan.

You must apply within six months after enrolling in Medicare Part B or receiving notification of your retroactive eligibility for Medicare Part B, unless you are entitled to Guaranteed Issue.

All AARP Medicare Advantage plans include the following payments:

The amount of each payment varies based upon the plan you choose and your state or region. The payments associated with PDP plans depend upon the tier of the drugs as described above in the Medicare prescription drugs section.

In order to enroll into AARP Medicare, you must:

To apply to be an AARP member, visit AARP.org/membership. On their site you will also find the monthly payment information and a full list of the benefits provided to members. In addition to healthcare insurance, AARP also offers car, vehicle, and property insurance, as well as a plethora of other benefits offered to members.

The second step is to be enrolled into Original Medicare. You will be automatically enrolled in Medicare Part A once you qualify for federal retirement benefits. If you are not automatically enrolled, you will need to enroll during your Initial Enrollment Period. The initial enrollment period begins three months before your 65th birthday and ends three months after your birthday. If you miss this period, you can enroll during the general enrollment which runs from January 1 to March 1.

You can enroll into Medicare Part B during the same time periods. This can be the Initial Enrollment Period or the General Enrollment Period if you happen to miss the initial. In the event of a life change such as your employer or spouse health insurance ends, you will have access to a special enrollment period.

When enrolling in medicare, you can consult an insurance agent or utilize free resources. In order to enroll, you can choose one of the three following options:

Once you are enrolled into Original Medicare, review the plans offered by AARP to determine which one(s) are the best fit for your situation. These plans have a lot of information, so feel free to request a free quote for more information. Call toll-free at 888-OUR-AARP (888-687-2277) or email member@aarp.org.

In the rich tapestry of history, the threads of Black LGBTQ+ narratives have often been overlooked. This journey into their stories is an ...